Kenya is in talks with the United Arab Emirates’ nationwide railway operator, Etihad Rail, to take over freight operations on the Normal Gauge Railway (SGR) beneath a concession association.

The plan comes as the federal government seeks contemporary methods to finance the subsequent part of the railway’s enlargement from Naivasha to Kisumu and Malaba.

Transport Cupboard Secretary Davis Chirchir stated the discussions contain Etihad Rail investing in rolling inventory, locomotives, and wagons, and operating freight providers on the road as soon as it’s accomplished. The federal government would retain possession of the railway infrastructure by way of Kenya Railways Company, which might proceed to deal with engineering and upkeep.

In keeping with Chirchir, Etihad Rail is focusing on freight volumes of about 17 million metric tonnes yearly to interrupt even or flip a revenue. This threshold would justify the corporate’s funding in working the freight facet of the SGR and make the concession commercially viable.

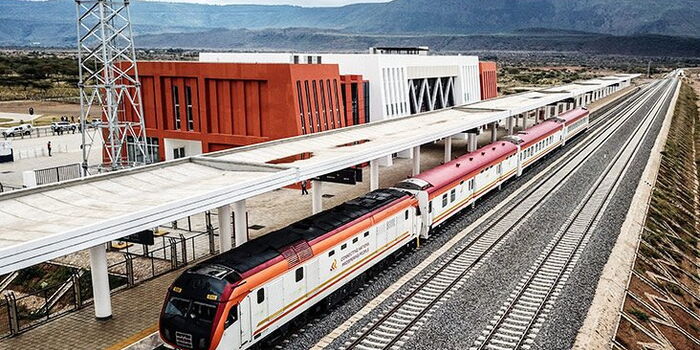

Kenya Railways Freight Service practice hauling by way of a piece of the railway.

Picture

Kenya Railways

Railway Line Extension

To fund the Ksh516.92 billion ($4 billion) wanted for the extension, Kenya plans to securitise its railway growth levy, a tariff charged at 2 p.c of the worth of all imports into the nation. The Treasury at the moment collects about Ksh50 billion ($387 million) from the levy annually.

Securitisation would contain changing this predictable stream of future levy collections into an upfront lump sum by promoting it to traders, permitting development to proceed with out including conventional sovereign debt. “We’re searching for to permit securitisation of this levy and use it to lift funds,” Chirchir stated in Nairobi.

The focused enlargement will hyperlink the present SGR line from Naivasha to the lakeside metropolis of Kisumu and on to Malaba on the Ugandan border, positioning the railway as a key regional commerce hall. #

The primary part of the SGR, accomplished in 2019, related the port of Mombasa to Naivasha by way of Nairobi at a value of Ksh646.15 billion ($5 billion).

The federal government says unbundling the railway business, separating infrastructure possession from operations, will assist entice non-public funding and enhance effectivity.

Beneath the proposed mannequin, non-public operators like Etihad Rail would give attention to operating providers whereas the state concentrates on sustaining the bodily community.

If concluded, the take care of Etihad Rail would mark the primary time Kenya’s SGR freight operations are managed by a overseas firm. It will additionally sign a shift from the unique method, which relied closely on Chinese language financing and administration.

The Ministry of Transport has additionally reached out to different worldwide growth lenders to finance infrastructure initiatives within the sector, with Chirchir noting that securing a number of streams of funding is essential to sustaining the railway’s long-term operations.

Treasury CS John Mbadi with Transport CS Davis Chirchir throughout the signing for the mortgage facility, in Beijing on September 6, 2024.

Picture

Treasury